The Netherlands introduced a healthcare-specific merger test on 1 January 2014. Companies that employ or contract more than 50 healthcare providers (either directly or indirectly) and are involved in a merger or acquisition (merger) must always notify the Dutch Healthcare Authority (NZa). The NZa has announced that it will adjust its policy regarding the healthcare-specific merger test on three points as of 1 July 2022. These three adjustments are addressed in this blog.

Scope of NZa merger test restricted as of 1 July 2022

All mergers involving a company that employs or contracts at least 50 healthcare providers, either itself or through its subsidiaries, must be notified to the NZa. This rule therefore also applies if not a single healthcare provider is directly involved in a merger (but a buyer has a healthcare provider elsewhere in the structure, for instance). This often meets with incomprehension among market parties – and rightly so.

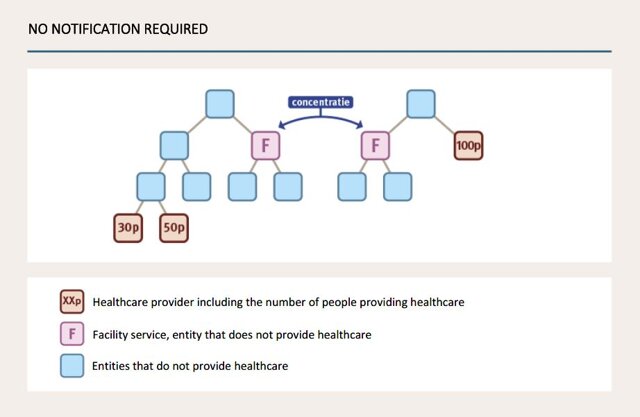

The above will change as of 1 July 2022. As of that date, mergers need only be notified to the NZa if a healthcare provider is directly involved. Direct involvement of a healthcare provider means that the entity entering into the merger or acquisition (i) provides healthcare itself or (ii) has indirect control over an entity that provides healthcare. A specific example of an acquisition that must currently be notified but that need no longer be notified after 1 July 2022 is an investment company that has a healthcare provider in its portfolio, but acquires a non-healthcare provider together with another non-healthcare provider. The NZa infographic below shows which types of mergers are no longer subject to the notification requirement as of 1 July 2022.

Types of mergers that need no longer be notified to the NZa as of 1 July 2022

We would have preferred the NZa to further limit the scope of the merger test (or preferably even to abolish it, as explained at the end of this blog). It could have decreed, for instance, that a merger need only be notified if it involves two healthcare providers. After 1 July 2022, mergers between a healthcare provider and a non-healthcare provider must also still be notified to the NZa. Our experience in recent years has shown that these specific mergers rarely, if ever, impact healthcare. The notification of such transactions to the NZa does, however, result in an (in this case unnecessary) administrative burden and delay in a merger process, while these transactions have little impact on healthcare.

Manner of involvement of clients and personnel to change as of 1 July 2022

In its merger test, the NZa assesses whether clients and personnel of a healthcare provider are sufficiently involved in the preparations for a merger. The Wet medezeggenschap cliënten zorginstellingen 2018 (Participation (Clients of Care Institutions) Act 2018) and the Wet op de ondernemingsraden (Works Councils Act) are currently decisive in this respect. If those Acts obligate a healthcare provider to set up a clients council or works council, that healthcare provider’s clients and personnel, respectively, must be informed in a timely manner about a merger. This allows them to raise questions about a merger or to make their recommendations about the merger known in good time.

This will also change as of 1 July 2022. The NZa will abandon the review framework under the Participation (Clients of Care Institutions) Act 2018 and the Works Councils Act. In future, the NZa will ask healthcare providers that are directly involved in a merger or acquisition always to inform their clients and personnel about a merger. Unlike in the past, this now applies even if a healthcare provider that is directly involved is not obligated to set up a works council ( more than 50 employees) or a client council (more than 10 or 25 healthcare providers). From 1 July 2022, the notifying parties may, however, make the case that a merger or acquisition will in no way affect some of their clients or personnel. In that case, those clients and that personnel need not be informed about the merger or acquisition.

With that last change, the NZa appears to want to address an issue that some (larger) companies are faced with in the healthcare-specific merger test. That issue is that employees and clients (for instance of healthcare providers that form part of a larger group) are informed about a merger despite obviously having no connection to it whatsoever. Practice has shown that being able to respond to merger plans or to exercise a right to be consulted is of little use in such cases and is therefore seldom used by the employees or clients in question. A case in point is a situation in which a healthcare provider makes an acquisition in Groningen, but employees and clients of another healthcare provider (but from the same group) in Maastricht have to be informed. It would appear that this will no longer be necessary as of 1 July 2022, but we will have to wait and see how the NZa will interpret this in practice. It is not yet possible to say how easily inclined the NZa will be to assume that a merger or acquisition will in no way impact certain clients or employees of a healthcare provider. We hope that the NZa will clarify this issue soon.

NZa to request more financial data in certain cases as of 1 July 2022

As of 1 July 2022, the NZa’s policy change will also have consequences for the information with which notifying parties must provide the NZa regarding the financial consequences of a merger. Currently, the same financial information must always be provided when the NZa is notified. That information consists of a five-year forecast of both the balance sheet and the profit and loss account of the organisation in question that best reflects the consequences of a merger.

After this NZa policy change, the amount of financial information to be provided will depend (in part) on the financial health of the organisations involved. The following situations (1) to (3) can be distinguished:

1. All the organisations involved have a positive operating income.

2. One of the organisations involved has a negative operating income.

3. In addition to the NZa’s approval, the approval of another external regulator (such as ACM or the European Commission) is required.

An overview of the documentation that must be submitted to the NZa in each situation can be found here. In situations (2) and (3), from 1 July 2022 onwards, the NZa will want to see more detailed financial substantiation of a merger in an NZa notification than in the past. Particularly in situation (3), the NZa will require more information from the parties as of 1 July 2022. In addition to a five-year forecast of the balance sheet and profit and loss account, a five-year forecast of the cash flow statement and the integration costs must also be submitted to the NZa when it is notified.

Healthcare-specific merger test: abolish rather than transfer or change

Since 2016, a bill has been pending relating to the transfer of the healthcare-specific merger test from the NZa to ACM. The bill is being handled remarkably slowly and has been pending before the Lower House for years. The bill will then have to be approved by the Upper House. In light of the lead time to date, we do not believe that the bill will enter into force this year. We therefore expect that the NZa will remain in charge of the healthcare-specific merger test for some time to come.

We have been strong advocates for many years of abolishing the healthcare-specific merger test altogether, rather than transferring or changing it. Other parties have also criticised the usefulness and necessity of the healthcare-specific merger test in recent years. When the healthcare-specific merger test was introduced, its purpose was to counteract the risks of “large healthcare conglomerates”, since mergers could lead to “too big to fail” healthcare providers. Partly as a result of ACM’s lowered healthcare thresholds alone, such mergers must also be notified to ACM. ACM has been very closely reviewing healthcare mergers for many years, approving them only subject to conditions (Parnassa / Antes) or even prohibiting them (e.g. Bergman Clinics / Mauritskliniek). On the basis of its own policy rule, ACM must furthermore already take into account (i) the views of the clients council, among others; and (ii) a number of healthcare-specific matters in its review of care mergers that lead to a market share of more than 35%. In sum, there is a substantive overlap with the NZa’s healthcare-specific merger test. Briefly stated, the NZa’s healthcare-specific merger test is superfluous. It leads to duplication and unnecessarily imposes a considerable administrative burden on healthcare providers.

Moreover, the healthcare-specific merger test places a considerable burden on the NZa’s capacity. Although the legislature assumed an average of 25 larger healthcare mergers per year that would be subject to the merger test, in practice that number turned out to be around 150 per year. The vast majority of the mergers notified to the NZa are relatively small in size. They often involve, for instance, notifications relating to the acquisition of a single dentist’s or physiotherapist’s practice. Such acquisitions are far removed from the review of “large healthcare conglomerates” for which the healthcare-specific merger test was initially intended.

In our opinion, the NZa would be better advised to redirect the considerable capacity it currently uses for the healthcare-specific merger test to tackle numerous more realistic problems in the healthcare sector, such as (i) supervision of healthcare procurement; (ii) the enforcement of the healthcare procurement obligation of healthcare insurers and care administration offices; (iii) the provision of information by healthcare insurers to consumers; and (iv) an effective approach to the growing healthcare policy jungle. We believe that tackling these problems in healthcare deserves much closer and more effective supervision by the NZa (but also by ACM), since supervision of each of these subjects goes to the heart of how our healthcare system works – which cannot be said about the NZa's healthcare-specific merger test at this time.

We have previously written about the changes to the healthcare-specific merger test of the NZa in Zorgvisie and M&A Community.

Follow Maverick Advocaten on Twitter and LinkedIn